Whether you’re in the middle of a challenge or already funded, the pressure’s on to make smart decisions—fast. One tool that’s been around forever but still packs a punch is the good ol’ Bollinger Bands. If you’re using MetaTrader 5 (MT5) for your prop firm trading, Bollinger Bands can seriously help you stay on top of price action and trade smarter, not harder. Let’s see exactly how to use Bollinger Bands inside MT5, how they fit into the prop trading world, and a few tricks to help you make the most out of them.

What Are Bollinger Bands?

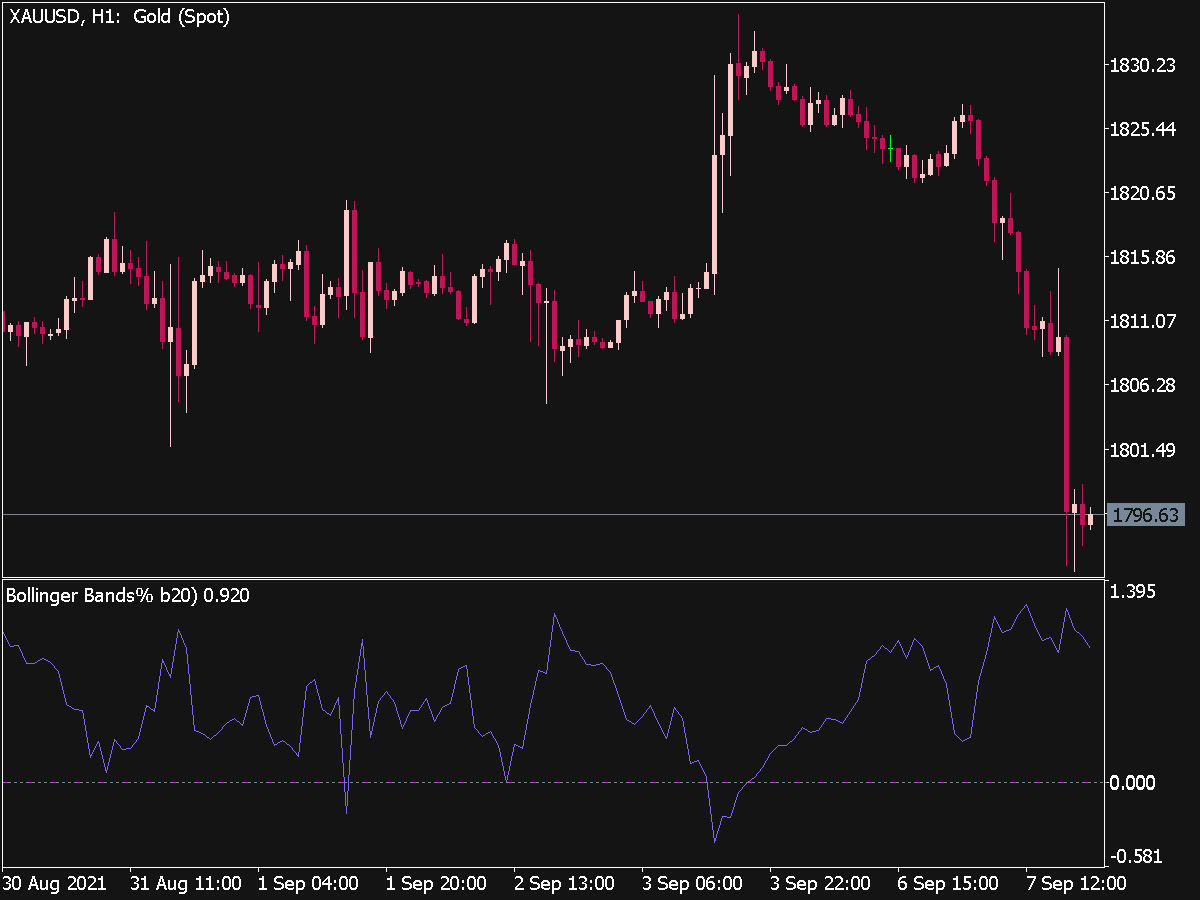

Bollinger Bands were created by John Bollinger back in the ’80s (yep, that far back). They’re basically a set of three lines plotted on your price chart:

- Middle Band: This is a simple moving average (usually 20-period).

- Upper Band: This is the middle band + 2 standard deviations.

- Lower Band: This is the middle band – 2 standard deviations.

Now, don’t let the standard deviation part scare you. All it means is that the upper and lower bands expand and contract based on how volatile the market is. The bands become bigger as things get crazy. They tighten up when the market is calm.

You can see a range of what is normal for price activity with this configuration. Anything except those bands? Perhaps it’s time to listen.

Why Bollinger Bands Matter in Prop Trading

The key to successful firm trading is discipline, consistency, and smart risk management. You have to abide with regulations, such as minimum trading days, maximum drawdowns, and daily loss restrictions, unlike ordinary traders.

Every trade must thus be significant. Put an end to reckless click-and-hope transactions.

Bollinger Bands are beneficial because they provide structure. As you can see:

- when there is an oversale or overbought market.

- Potential breakout zones.

- when the price is going back to its average.

- changes in volatility are indicators of significant movements.

In a prop firm context, these insights may be quite valuable. They assist you avoid chasing price like a headless chicken and give you more confidence when timing your entrances and exits.

How to Add Bollinger Bands in MT5

Here’s how you do it:

- Open your MT5 trading platform and head to any chart.

- On the top menu, click Insert > Indicators > Trend > Bollinger Bands.

- A pop-up will show up with the settings. The default is:

- Period: 20

- Deviation: 2

- Apply to: Close

- Hit OK and they’ll appear on your chart.

You’ll see a center line (the moving average) with two outer bands hugging price. Now you’re in business.

Core Ways to Use Bollinger Bands for Prop Trading

Let’s talk about the real deal now and how you actually use these bands to make trading decisions.

Mean Reversion Plays

This is probably the most common way traders use Bollinger Bands. The idea is simple:

- When price touches the upper band, it might be overbought.

- When it hits the lower band, it might be oversold.

You’re basically betting that price will snap back to the middle line, which is the mean (average).

Example Setup:

- Price spikes and touches the upper band.

- You notice RSI is overbought too.

- You wait for a bearish candlestick to form (maybe a pin bar or engulfing candle).

- You enter a short position and aim for the middle band.

It’s not about guessing tops or bottoms—it’s about waiting for confirmation and trading the bounce.

Why it works for prop firms:

You’re not holding positions forever. These quick snapbacks can help you score profits within your risk limits and meet minimum trading day requirements without getting into trouble.

Bollinger Band Squeeze (Breakout Strategy)

The Bollinger Band “squeeze” is where things get exciting.

When the bands narrow, it means the market’s been quiet for a while—volatility is low. But here’s the kicker: Low volatility often leads to high volatility. So when the squeeze happens, a breakout is usually around the corner.

What to look for:

- Bands get super tight (squeeze).

- Volume starts to tick up.

- A big bullish or bearish candle breaks out of the band.

Once that breakout happens, you can ride the momentum.

Example Strategy:

- Wait for the squeeze.

- Place pending orders above and below the squeeze zone.

- Let price break out and trigger your trade.

- Trail your stop or target a 1:2 or 1:3 risk-reward.

Perfect for prop trading because:

- You can catch explosive moves with minimal risk.

- It helps you avoid overtrading during choppy conditions.

- You only need a few good trades to hit your profit targets.

Trend Continuation Using Bands as Dynamic Support/Resistance

This one’s a little more advanced but super effective.

When price is trending, it often rides the upper or lower band like a wave. Instead of fighting the trend, you use Bollinger Bands to find pullbacks for entry.

Here’s how:

- In an uptrend, price pulls back to the middle band.

- You look for a bullish candle at that level.

- You enter long and target the upper band again.

It’s kind of like buying the dip but with structure.

Why this helps in prop firm accounts:

- Keeps you trading with the trend (less risky).

- Allows tight stop-loss placement.

- Matches perfectly with prop firm goals: small risk, repeatable setups.